Dubai home prices rise 17% in second quarter with further increases expected

Prime locations clock 125% increase since January 2020

Dubai’s residential real estate prices rose 17 per cent in the second quarter on an annual basis, marking the 10th consecutive quarter of expansion, amid strong demand and robust economic growth.

Property prices in the April to June period rose 4.8 per cent from the previous quarter, according to consultancy Knight Frank.

Apartment prices in the emirate increased 21 per cent since January 2020 to an average of Dh1,290 ($351) per square foot currently, while villa prices jumped 51 per cent over the same period to Dh1,520 per square foot on average, Knight Frank said in a market report on Wednesday.

“The relatively long-run of price growth is showing no signs of slowing. If anything, all the market dynamics continue to point towards further increases, particularly when it comes to villas as the supply-demand dynamic remains out of kilter,” Faisal Durrani, partner and head of research for Middle East and Africa at Knight Frank, said.

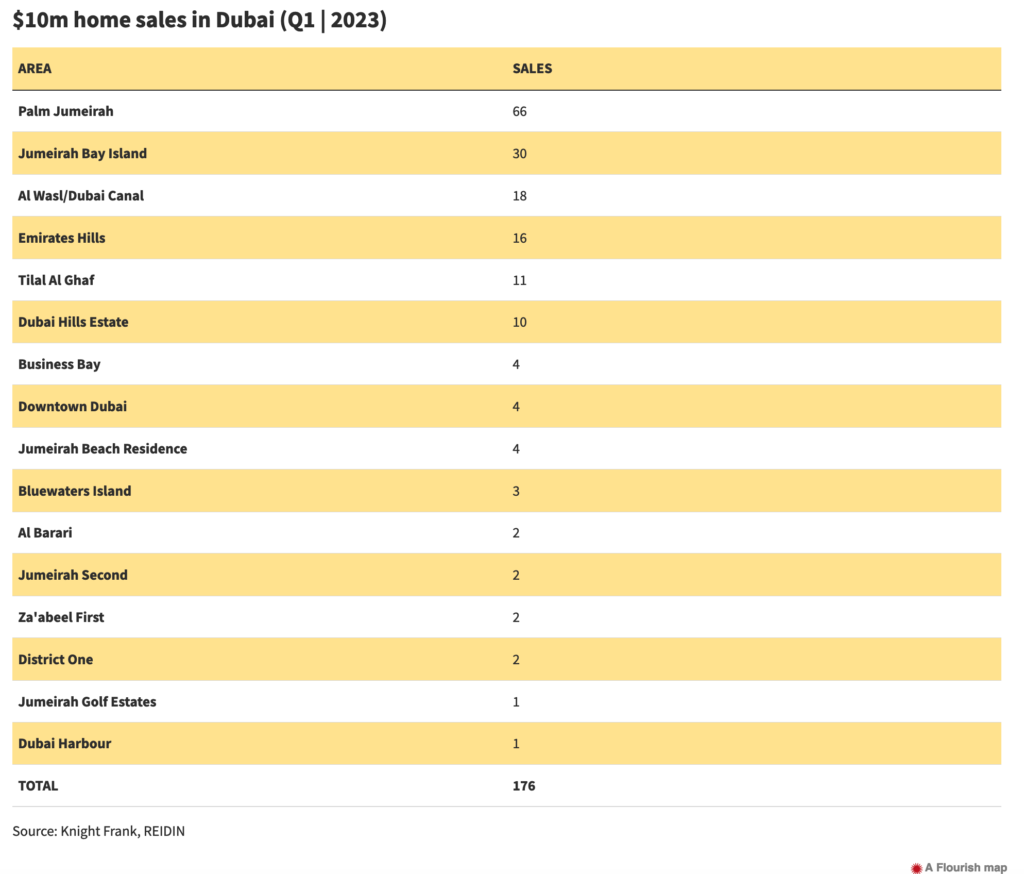

This is particularly evident in the emirate’s prime markets of Jumeirah Bay Island, Emirates Hills and Palm Jumeirah, where villa prices are up 11.6 per cent in the second quarter and 125 per cent since January 2020, with only eight villas under construction in these areas, he said.

DUBAI PROPERTY PRICES

Average value of residential transactions since 2003 (dirham/per square foot)

Villa prices across the rest of the city “remain supercharged” and are 5 per cent above the 2014 peak, he added.

More affordable locations around the emirate are also experiencing strong price increases on a per square foot basis. Villas in Dubai Hills Estate, for example, have registered 24 per cent growth in values in the past 12 months, marking the fastest rate of growth in the city.

A major factor behind this growth is the “robust and sustained” demand for luxury second homes, especially from international buyers, but also from domestic purchasers, Knight Frank said.

The Palm Jumeirah remains Dubai’s top-performing villa market, with prices growing by 9 per cent in the second quarter alone, propelling the growth rate to 44 per cent over the past year, according to the report.

Villa prices in Palm Jumeirah have risen by 146 per cent since January 2020, and are at about Dh4,800 per square foot. Villa prices in the area are now 67 per cent higher than their 2017 peak, while apartments still lag their last peak in 2015 by 7 per cent, the data showed.

Dubai’s property boom is not going to slow down anytime soon, according to real estate experts, as a rising population, minimal taxes and the global economic climate continue to drive optimism.

Dubai’s property market has bounced back strongly from the coronavirus-induced slowdown, helped by government initiatives such as residency permits for retirees and remote workers.

The emirate’s move to expand the 10-year golden visa programme, the economic gains generated by Expo 2020 Dubai and higher oil prices also supported property market growth momentum.

Dubai’s economy grew an annual 2.8 per cent in the first quarter of the year to Dh111.3 billion, extending the “robust momentum of growth” achieved in 2022, when the emirate expanded by 4.4 per cent.

Real estate activities grew 2.4 per cent in the first quarter, driven by a sharp rise in property sales with the sector contributing 7.4 per cent to the economy, according to government data.

Off-plan sales in the emirate are also on the rise.

“With a rise in the volume of product launches over the last 12 to 18 months, as developers respond to the stable and sustained demand for homes, the volume of off-plan homes sold has been unsurprisingly rising, now accounting for just over 50 per cent of sales,” Mr Durrani said.

Ready property remains in high demand, particularly among international second home buyers who are looking for instant access to the ‘Dubai lifestyle’, Shehzad Jamal, partner and head of strategy and consultancy in the Middle East & Africa at Knight Frank, said.

It is strongest among those with a net worth of more than $10 million, as well as high-net-worth individuals from East Asia. Overall demand for off-plan purchases is relatively low at just 10 per cent among global HNWI, he said.

In terms of supply, by the end of 2028, Knight Frank expects 85,200 homes to be delivered, with 69 per cent of them being apartments (59,000 units).

About 40,000 homes are projected for completion this year alone, with a portion likely delayed to next year, the consultancy said.

Around 42,500 units are scheduled for completion between 2024 and 2028, representing an average of just 8,500 homes per year – a 75 per cent reduction on the long-term rate of home deliveries. This indicates continued upwards pressure on prices, particularly as the population continues to swell, recently surpassing 3.5 million residents, Mr Jamal said.